An uninformed car owner may consider a vehicle protection plan as an extra expense, but the truth is that it pays so much more than just repairs and replacements for the vehicle. More than anything, it pays for your peace of mind, on and off the road, especially when you find the right provider like CarGuard Administration.

On average, more than 6 million passenger vehicle accidents happen in the U.S. every year. Many of these accidents cause damage to life and property, including the vehicle itself, causing millions in repair costs. A reliable vehicle protection plan is a prudent way to maintain your car and protect your investment.

What is a Vehicle Protection Plan?

A vehicle protection plan is a service contract that provides coverage for repairs of covered car parts or components in case of a mechanical breakdown.

This add-on coverage can be purchased at an extra cost by the dealership or a third-party company. Once a vehicle plan has been purchased, it will cover the costs of car repairs and parts replacement.

There are also added services that the car owner can enjoy, depending on the plan chosen and on the company offering the plan. A vehicle protection plan is different from the manufacturer’s warranty. Once purchased, cars come with a warranty that the manufacturer covers.

This warranty is a guarantee by the manufacturer that the vehicle has no defect and that the covered components will function properly for a specific amount of time, usually based on a specified period or mileage.

The warranty may also cover the car’s electronics, power seats, and other parts, depending on the manufacturer. An added coverage, such as a powertrain warranty, will cover the engine and transmission.

While good enough, a manufacturer’s warranty is limited because it only covers the vehicle for a limited time. It will not protect the vehicle for the rest of its usable life.

A vehicle protection plan like those offered through CarGuard Administration will take over once the manufacturer’s warranty ends. Depending on the plan, vehicle protection coverage will cover car issues that the warranty does not. A vehicle protection plan is also called a vehicle service contract or extended warranty.

Why You Need a Vehicle Protection Plan

A manufacturer’s warranty will not last forever, so you need a vehicle protection plan to cover your vehicle when the warranty expires. Finding the right provider is the first step, and CarGuard Administration has been a leader in the industry for many years. A vehicle protection plan offers several benefits, which are outlined below.

1. Paying For Future Security

A vehicle protection plan will take over after the manufacturer’s warranty ends. In case of damage or replacement of a car component in the future, the plan will take care of it. It is essentially buying protection for any future issues.

2. Save Money

Without coverage, a car owner is potentially looking at spending hundreds, if not thousands of dollars on the cost of repair out-of-pocket.

A starter alone can set you back by about $470, while a transmission can go for at least $5,000. A vehicle protection plan is essentially like buying health insurance for your car. In case of a problem, your car will have the coverage it needs.

3. Receive Roadside Assistance

A key perk of having a protection plan is having access to roadside assistance when you need it most. Car breakdowns can happen anytime and sometimes in the most inconvenient places. An emergency roadside assistance service will locate you and your car and offer several services based on your needs, such as vehicle removal through towing or crane, tire replacement, lockout service, battery jumpstart, fuel delivery, and others.

4. Affordable Protection

Vehicle protection coverage comes in many plans for car owners to choose from. These plans vary in their coverage, with some plans offering more protection.

Regardless of your plan, you can enjoy comprehensive vehicle protection at an affordable price. In case a breakdown or damage occurs, you have the assurance that the cost of repairing your car is covered.

5. Protect Your Budget

Costs can quickly add up in case of a car breakdown or accident. Vehicle owners who intend to keep using their cars for more years want to be able to enjoy their investment without worrying about the expense. With a protection plan, a car owner has the assurance that their car will receive the care and service it needs without overwhelming their budget.

6. Finding the Right Vehicle Protection Plan

Founded in 2015, CarGuard Administration is a leading provider of vehicle protection plans in the U.S. Now based in Phoenix, Arizona, CarGuard provides services that focus on their client’s requirements and prioritizes their needs. They offer several protection plans designed to address their clients’ unique problems.

One of these protection plans is the CarGuard Platinum Deluxe. There are many reasons why their clients prefer this plan, thanks mainly to its coverage. It is currently one of the best protection plans available that focuses on ensuring that the vehicle owner’s needs are met.

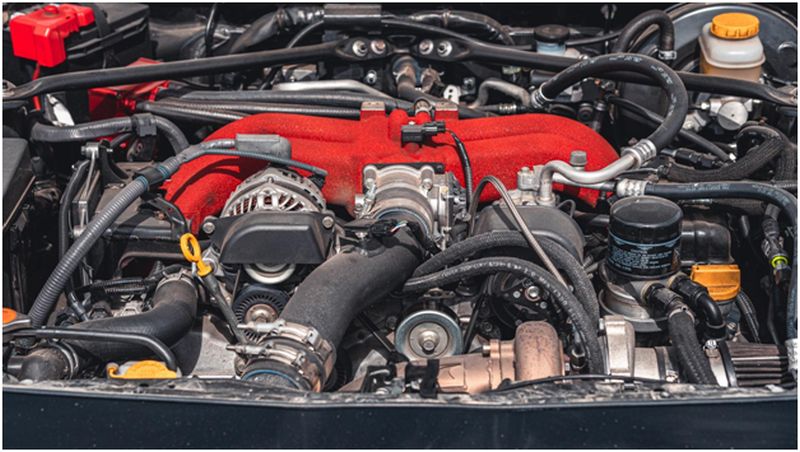

If your vehicle suffers damage to its engine, transmission, A/C, suspension, cooling system, or fuel system, you are assured of timely and professional assistance from CarGuard through their Platinum Deluxe plan.

CarGuard Administration understands the importance of getting immediate and complete service when needed. Your vehicle is an investment, and what better way to take care of it than to ensure its protection for years to come?

Article Submitted By Community Writer